Case: Russian Federal Tax Service Platform. Launched digital services

Digital Power of Attorney

- Supports B2B and B2C. Users (legal entities and individuals) create Electronic Documents for seamless exchange with government authorities and economic entities.

- Issuing entities easily manage, revoke, and issue new Powers of Attorney.

- Validity can be verified through the distributed registry.

Taxpayers Distributed Ledger

- Credit History Taxpayer Service is able to provide taxpayer history whether an individual or a legal entity.

- Each profile includes all necessary statements, declarations, contracts, and other data and divided into two parts: open and closed. Only with taxpayer's consent, selected data from the closed part of the profile is sent to chosen banks. Conversely, a bank can request information from the open part of the taxpayer's profile.

- The document transfer allows credit organizations to automatically access all necessary information about the borrower during the provision of services, scoring, taxpayer registration in various services, and other processes.

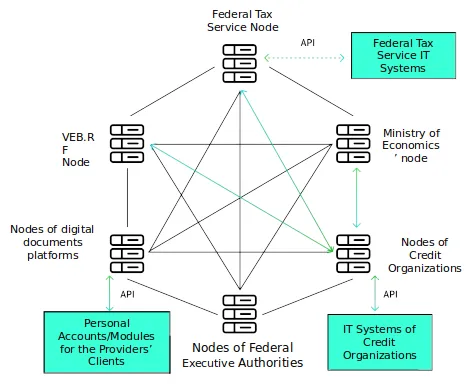

Scale of platform deployment

- 22 governmental agencies connected.

- 65+ banks connected.

- 30+ operators of digital document platforms connected.

- More than 200 blockchain nodes in the network.